is car loan interest tax deductible in india

Of course the claimed home must serve as a primary or secondary residence and cant be added to the two-home deduction limit that the IRS imposes. Unfortunately car loan interest isnt deductible for all taxpayers.

How To Get A Tax Benefit For Buying A New Car Axis Bank

No one can only claim a deduction us 80EEB on the interest payment of the loan.

. So your total taxable profit for the year will be Rs 476 lakh after deducting the interest that you paid towards repaying the Car Loan. Interest on car loans may be deductible if you use the car to help you earn income. One of the biggest perks of the Mortgage Interest Tax Deduction is its international reach.

Read on for details on how to deduct car loan interest on your tax return. Experts agree that auto loan interest charges arent inherently deductible. It can also be a vehicle you use for both personal and business purposes but you need to account for the usage.

This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan. Replied 30 October 2021. The answer to is car loan interest tax deductible is normally no.

Regular taxpayer such as salaried person or any other head other than business or profession do not have any benefits of Car loan. Car loans availed by individual customers do not offer any tax benefit. If a Salaried person takes a Car Loan then he cannot claim the Interest on Car Loan as an expense.

For instance assume you are a business owner and you buy a car for commercial purposes. Tax Exemption on CarAuto Loans Car loans availed by individual customers do not offer any tax benefit Car loans availed by self-employed individuals for 27. Sourav Student 23963 Points Replied 31 October 2021.

For how many years can I claim a deduction under section 80EEB. Interest on loans is deductible under CRA-approved allowable motor vehicle expenses. Car loans availed by self-employed individuals for vehicles that are used for commercial purposes are eligible for tax deduction under section 80C of the Income Tax Act.

2012-13 decided on 07022018 apart from other issuesgrounds the assessee claimed lease rental. You can only claim car loan tax benefits on the interest and not the principal amount. India Introduces Interest Deduction Limitation Rules in Finance Act 2017.

Advocate Akhilesh Kumar Sah. Tax Exemption on Personal Loans. In case of Business the car will be shown as an asset and interest will show as deduction in PL account.

Tax Benefits on Loans in India Check all Exemptions. Should you use your car for work and youre an employee you cant write off any of. Formerly Philips Electronics India Ltd.

But you can deduct these costs from your income tax if its a business car. In case youre thinking of selling your house within five years of buying it or from the date of taking the loan say goodbye to your tax benefits. In order to do this your vehicle needs to fit into one of these IRS categories.

Only business and professional people who maintain regular accounts can claim interest paid on car loan as expenditure under section 37 of income tax act 1961. The benefits will be reversed and you will need to pay extra tax. You cant claim deduction of car loan if its not an electric car in case of salaried person.

It is fairly clear that the interest paid on home loan is allowed as a deduction in all cases. In the Union Budget 2019 the government has announced a deduction from the income for purchase electric vehicle. This means that if you pay 1000 in interest on your car loan annually you can only claim a 500 deduction.

An individual can claim a deduction under this section until the repayment of the loan. It is predefined in the Income Tax Act that money utilized in the form of business loans is not the same as business. The only differentiating factors here will be if you claim for personal property or an investment one.

If on the other hand the. In this case you will receive different tax deductions. Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer 10.

Tax Deduction for Interest paid on Car Loan Chartered Club. If the taxable profit of your business in the current year is Rs 50 lakh Rs 24 lakh 12 of Rs 20 lakh can be deducted from this amount. Taxpayers may claim this deduction on their foreign mortgages.

Automobile loan interest Vehicle maintenance Insurance Tolls and parking fees Gasoline Oil Change. For this you take a loan of 10 lakhs at 12 interest for one year. There is no deduction for interest on car loan.

It is only allowed to be treated as an expense where the Car is being used for Business purposes. You are allowed to claim deductions on the interest paid in five equal instalments over a period of five years from the year of possession. 08 February 2008 If the car is used wholly and exclusively for business purpose then he can claim deduction.

As per the Income Tax Act 1961 you can avail deduction on business loan interest that is paid from business profits. In fact qualifying US. Few significant points about car loans in India are listed below.

A person running a business can claim interest on car loan as deduction of Interest on car loan from his Profit computed under Profit or Gain from Business or Profession. To determine the amount of each actual vehicle expense that may qualify for a tax deduction you will need to calculate the percent of time that the vehicle is used for business. Well you can.

08 February 2008 Respected members. Recently in Phillips India Ltd. As the interest on car loan is allowed to be treated as an expense this reduces the taxable profit which in turn reduces the Income Tax to be paid.

On March 31 2017 India enacted Finance Act 2017 which introduces measures in Clause 43 to limit interest expense deductions on related-party debts to 30 of the debtors Indian company or an Indian permanent establishment PE of a foreign company earnings before interest taxes. The answer is Yes. 2 Bill 2019 introduced a new section 80EEB for allowing a deduction in respect of interest on loan taken for the purpose of purchase of electric vehicles with effect from the AY 2020-21.

The interest you pay on your business is tax deductible that is generally subtracted from your gross income. To put it simply yes you may claim an India home loan while you are in the US. Deduction of lease rentals paid towards cars taken on finance lease allowed while computing income.

When you take out a personal loan or borrow from a credit card for example you pay a higher interest rate and cannot claim a deduction on 28. However the interest paid on car loan is not allowed as an expense in all cases.

Use The Interactive Home Loan Emi Calculator To Calculate Your Home Loan Emi Get All Details On Interest Payable And Tenure Us Home Loans Loan Calculator Loan

Documents Required For New Car Loan New Car Loan Documentation Hdfc Bank

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Charging India S Green Future Sbi Is Proud To Provide India S First Green Car Loan To Encourage People To Reduce Their Ca Green Car Car Loans Carbon Footprint

How Much Income Tax You Can Save On Buying An Electric Car Mint

How A Self Employed Can Apply For A Car Loan Axis Bank

New Income Tax Deduction U S 80eeb On Car Loan Deduction On E Vehicle Loan Interest 80eeb Youtube

Is Car Loan Eligible For Tax Exemption Paysense Blog

Car Loan Tax Benefits On Car Loan How To Claim Youtube

Car Loan Tax Benefits And How To Claim It Icici Bank

Section 80eeb Deduction For Interest On Loan For Purchase Of Electric Vehicle

Save Income Tax On Car Loan By Opting For Ev Here S How

.jpg)

How A Self Employed Can Apply For A Car Loan Axis Bank

Is Zero Percent Car Loans Really A Good Deal Or Is It A Dealership Trick Quora

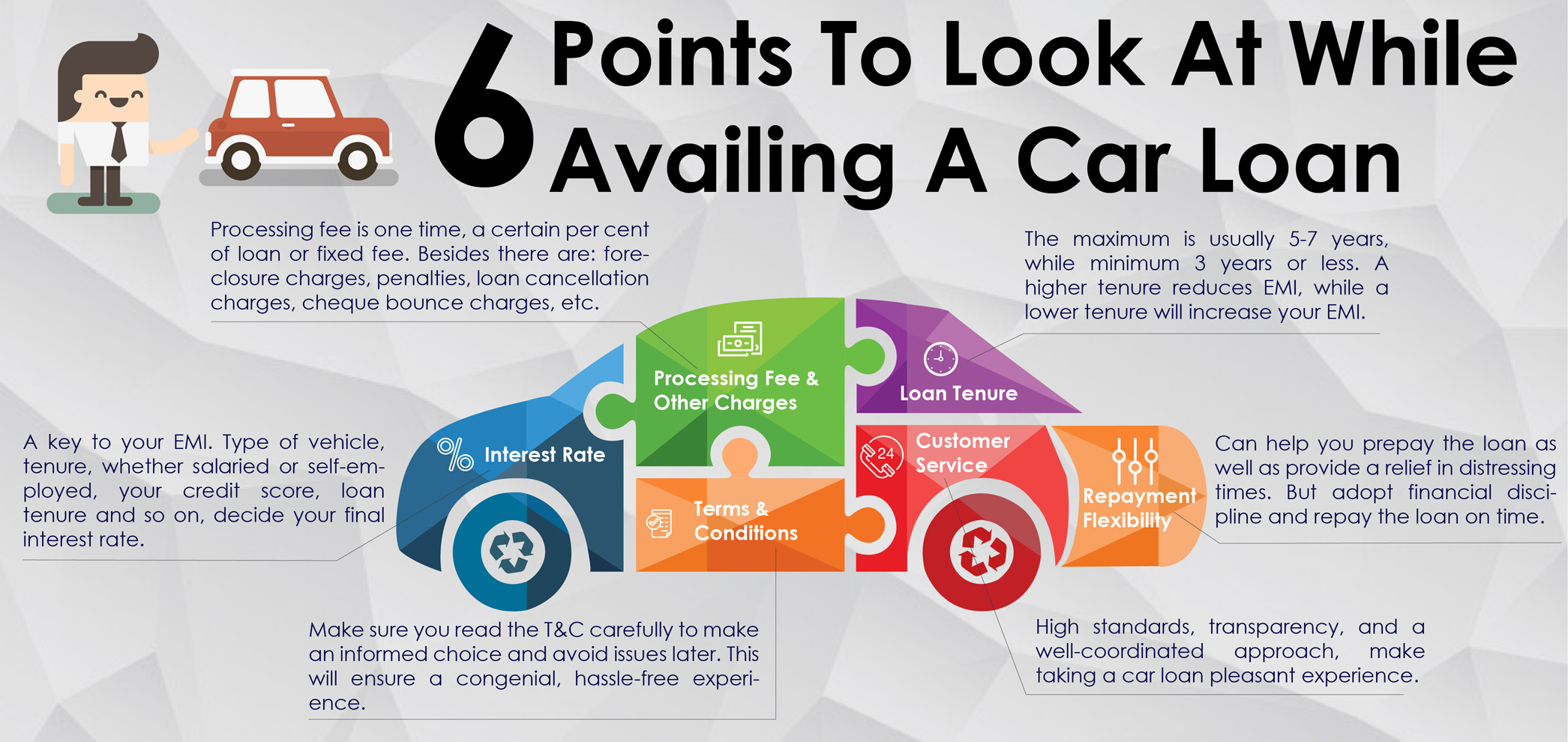

Car Loan Processing Fee Other Types Of Charges

New Higher Rate Of Depreciation On Motor Car Motor Car Car Motor

10 Things You Should Never Deduct From Your Taxes All Time Lists Best Car Insurance Car Insurance Online Cheap Car Insurance

6 Points To Look At While Buying A Car For Your Family This Festive Season Axis Bank